The FY 2011-12 total operating budget of $63.4 billion, which included $27.1 billion in General Fund spending, represented the first year-to-year reduction in state spending in at least 40 years. However, as the economy continues to struggle out of a recession and with increasing costs in public welfare, corrections, pensions, and debt, the FY 2012-13 budget will require even more difficult decisions by the General Assembly and Governor Corbett to put Pennsylvania on a path to prosperity.

Spending has Dramatically Outpaced Inflation in PA

- Pennsylvania's budgetary challenges stem from spending that has outpaced taxpayers' ability to pay.

- From 1970 to 2012, state government spending increased from $4 billion to $63 billion, an inflation-adjusted increase of $11,800 per family of four (or $2,950 more per resident).

- If state government had limited its spending growth to inflation plus population since 2000, taxpayers would be saving more than $10 billion dollars this year, or $3,412 per family of four (or savings of $853 per resident).

Pennsylvania State Budget Basics

While the General Fund Budget is the primary focus of both legislative discussions and public attention, it represents only about 43% of the commonwealth's Total Operating Budget.

- Total Operating Budget (enacted, June 2011) = $63.4 billion

- General Fund Budget (enacted, June 2011) = $27.1 billion

- Federal Funds (estimated) = $22.1 billion

- Special Funds (estimated) = $4.3 billion

- Other Funds (estimated) = $9.8 billion

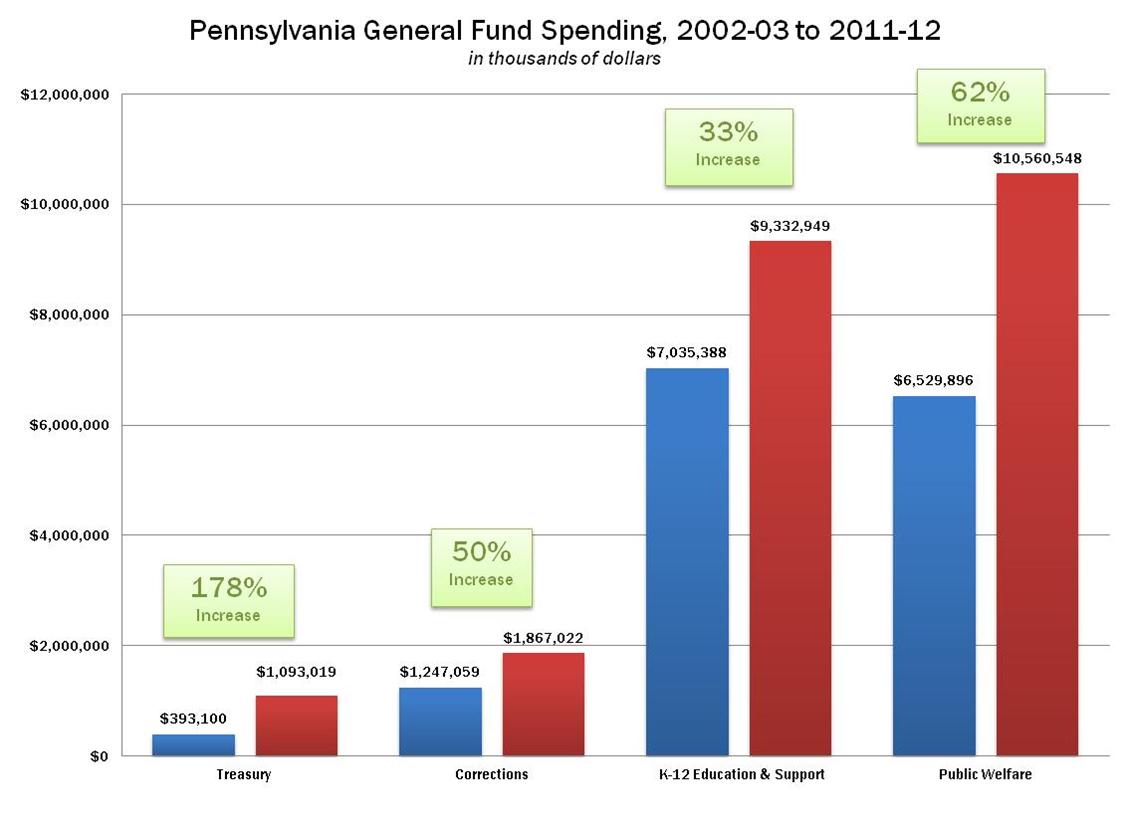

- General Fund spending increased by $7.2 billion (35%) from FY 2002-03 to 2011-2012.

- K-12 Education, Public Welfare, Corrections, and Treasury (debt payments) represent 84% of the General Fund Budget; but these four areas represent 100% of the growth.

- K-12 Education, Public Welfare, Corrections, and Treasury grew by $7.6 billion.

- All other programs and departments were reduced by $426 million.

Budget Threats to Pennsylvania's Fiscal House

- The FY 2011-12 General Fund budget, as enacted, spends $578 million more than expected revenue.

- Total revenue collections through January 2012 were $497 million behind forecasts.

- Combined, this creates a budget gap of more than $1 billion dollars.

- The Pennsylvania Independent Fiscal Office's report on long-term trends suggests General Fund revenue growth will average only 1.6% annually for 2011-14.

- Projected growth in major spending areas between 2011 and 2014, absent reform, far outpace expected revenue growth.

- Public Welfare spending - the single largest area of the state budget - is projected to grow 8% per year.

- Corrections spending is expected to grow 6.9% per year.

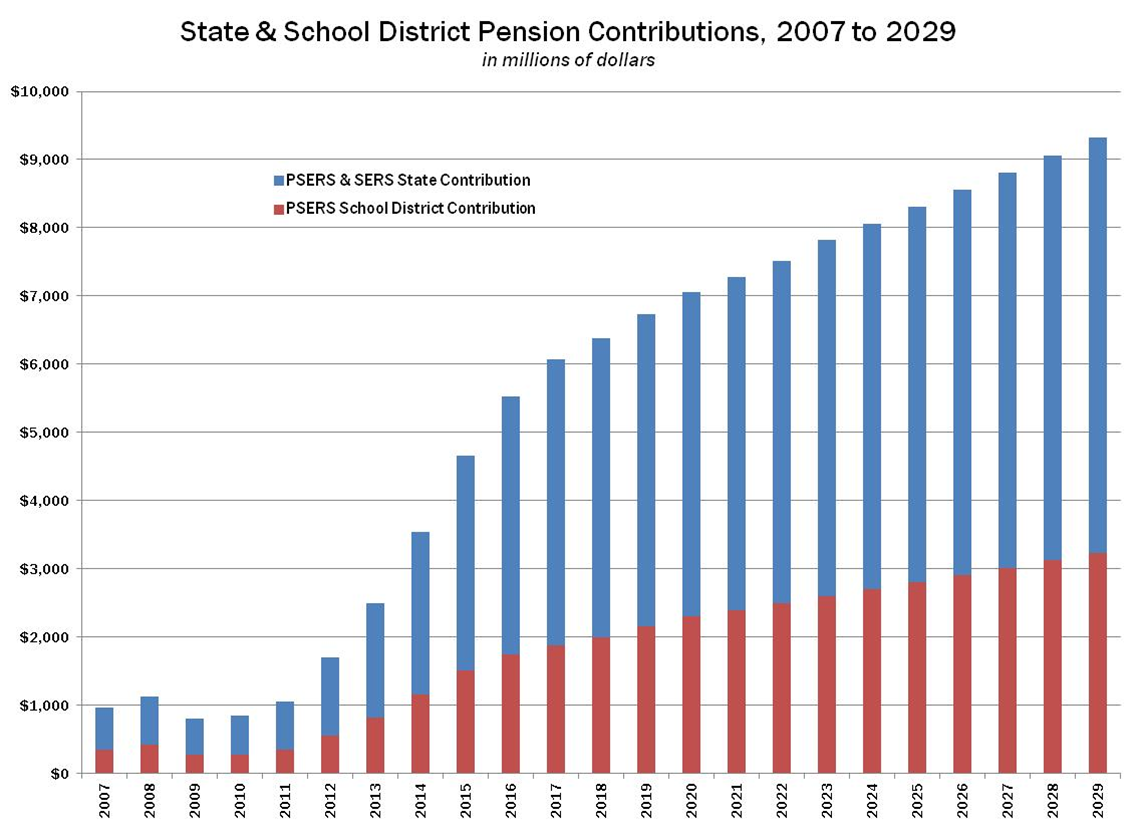

- Pension contributions will increase by 40% per year.

- Debt payments are forecast to grow by 7.3% annually.

Debt, Taxes, and Economic Growth

- From 2002 to 2010, Pennsylvania state debt increased 89%, from $23.65 billion to $44.7 billion.

- Today, Pennsylvanians owe $120 billion in combined state and local government debt—almost $10,000 for every man, woman, and child.

- Today, Pennsylvanians owe $120 billion in combined state and local government debt—almost $10,000 for every man, woman, and child.

- Pennsylvania has the 10th highest state and local tax burden out of the 50 states, up from 24th in 1990, according to the Tax Foundation.

- Pennsylvania taxpayers pay $4,190 per capita in state and local taxes, 10.1% of their income.

- Pennsylvania taxpayers pay $4,190 per capita in state and local taxes, 10.1% of their income.

- From 1991-2011, Pennsylvania ranks:

- 41st in Job Growth

- 46th in Population Growth

- 48th in Personal Income Growth

- Pennsylvania's private sector lost 116,400 jobs, while government jobs grew by 30,800 between 2000 and 2010.

- According to IRS data. Pennsylvania lost a net 77,184 taxpayers to other states from 2000 to 2010,

- This out-migration resulted in a net loss of $4.3 billion in household income.

- This out-migration resulted in a net loss of $4.3 billion in household income.

- However, 2011 saw the largest one-year growth in private sector jobs in Pennsylvania since 1999, according to Bureau of Labor Statistics data.

- While government jobs declined by 20,200, private-sector jobs grew by 79,000.

- Manufacturing job growth in Pennsylvania was higher than any year since 1990.

Principles for Sound Budgeting

- No new taxes. A fiscally sound budget will not increase, and will set the framework for reducing taxes on hard-working citizens of the commonwealth.

- Government must live within its means. Spending must not exceed revenues. Spending growth should be limited to the cost of providing government services.

- Policy Recommendation: Constitutionally limit spending growth to inflation plus population.

- Policy Recommendation: Constitutionally limit spending growth to inflation plus population.

- Prioritize every dollar. Politicians should avoid the "Washington Monument ploy" of threatening to cut popular programs while retaining gratuitous projects.

- Policy Recommendation: Eliminate the Redevelopment Assistance Capital Program. State borrowing should be for roads and bridges, not corporate welfare.

- Policy Recommendation: Eliminate the Redevelopment Assistance Capital Program. State borrowing should be for roads and bridges, not corporate welfare.

- Fund results, not programs. Traditional budgeting provides increased funding for existing programs, even those that aren't producing results. Reality-based budgeting calls for establishing goals, measuring outcomes, and only funding programs that work.

- Policy Recommendation: Fund kids, not schools. Increase parental choices of schools.

- Policy Recommendation: Adopt public welfare policies that reduce dependence on government, increase true charity care, and foster personal responsibility.

- Policy Recommendation: Implement criminal justice reforms that improve rehabilitation efforts, increase safety, and save money.

- Eliminate unnecessary spending. Government has no money of its own; it has only that which it first removes from the productive sector of society. Unnecessary spending means there are fewer dollars in the private sector which would be better spent, saved, or invested in the economy.

- Policy Recommendation: Privatize "yellow pages government:" If a services can be found in the yellow pages of a phone book government should consider buying it rather than producing it.

- Policy Recommendation: Redefine prevailing wage laws that drive up the cost of public construction projects.

# # #

For more information on the Pennsylvania State Budget, visit www.CommonwealthFoundation.org/Budget