The founder of Pennsylvania, William Penn, believed strong liberty of conscience was essential to a flourishing society. But Pennsylvania’s current slough of sin taxes shrug off Penn’s warning.

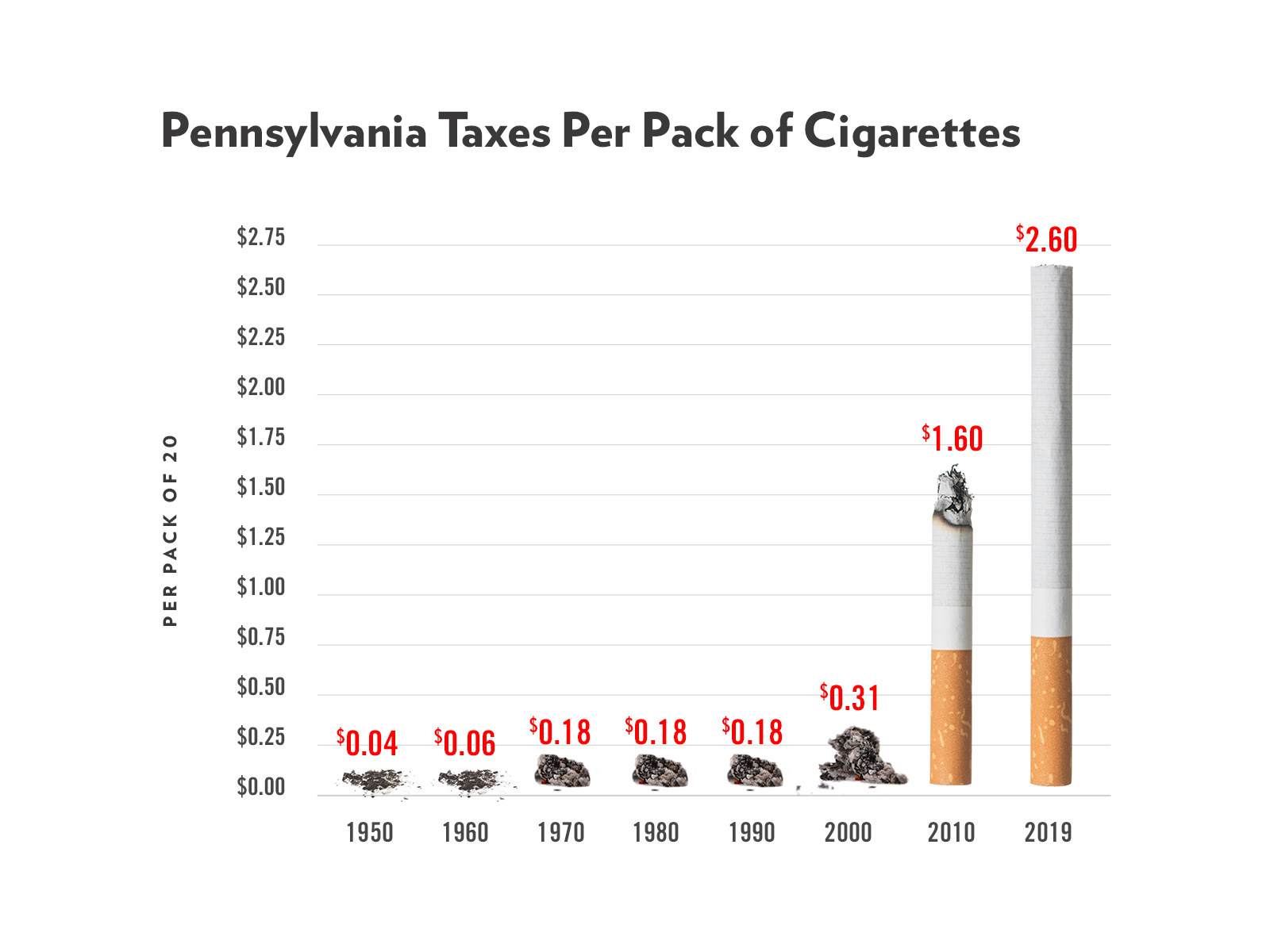

Pennsylvania’s sin taxes cover everything from sugary drinks to alcohol, gambling, and tobacco. According to data from PennWatch, tobacco is a major revenue source, with the largest portion—over $1 billion in 2018-19—taken from the cigarette tax.

There are two primary motivations behind targeting these specific behaviors with taxes. On the one hand, there are financial motivations, and on the other, an effort to reduce unhealthy behaviors. However, in the long term neither of these goals is fully accomplished by sin taxes—especially cigarette taxes.

A plethora of studies say the same thing: sin taxes are unreliable as a revenue stream. A 2018 study by The Pew Charitable Trusts and the Nelson A. Rockefeller Institute of Government, found that cigarette and other sin taxes can raise revenue in the short-term, but aren’t reliable in the long-term.

From a public health perspective, taxing cigarettes doesn’t result in a very high return. A working paper by the National Bureau of Economic Research found that the tax’s impact on behavior was minimal and a tax increase of 100% would be needed to curb consumption as little as 5%.

Additionally, the reduction in these behaviors—regardless of intensity—may not be distributed evenly across income levels. A 2018 study found that taxes were least effective at curbing consumption for users who made under $25,000. This adds to the evidence that sin taxes are one of the more regressive taxes governments can implement.

According to the Center for Disease Control and Prevention (CDC), the highest rate of tobacco use occurs in populations below the poverty level, and this is most pronounced in cigarette use. This means that the poor are shouldering the brunt of the tax burden.

It’s not just poor individuals who are targeted with additional taxes. In 2016, Pennsylvania passed Act 84, which put a 40% tax on vape products and resulted in almost a third of the state’s vape shops closing.

Tobacco taxes not only result in legal businesses closing, but also encourage the growth of illegal activity. The Mackinac Center has done extensive research on cigarette smuggling and has found that Pennsylvania has the 17th highest rate in the nation, higher than any of its neighbors—except New York, which is the highest.

Overall, the current system of cigarette taxes is a failure at worst and discriminatory at best, as it targets poorer populations and small business owners.

Targeted taxes don’t follow the spirit of Pennsylvania’s income tax which is broad-based and has a single rate. Lawmakers need to take a page out of their own book and enact comprehensive tax reform that follows the same method. Applying this principle across all goods and services—even tobacco—will create a fairer tax code for all residents of the Commonwealth.

This is part of a series on how Pennsylvania’s Sin Taxes disproportionately impact the poor. Click here to learn more about the impacts from Philadelphia's Soda Tax.

RELATED : SMOKING, TAXES & SPENDING, TAX REFORM